Algorithmic trading – or simply algo trading – has transformed how smart traders approach the markets, and nowhere is this shift more visible than on Delta Exchange. If the idea of automated trading still seems out of reach or you’ve felt intimidated by the requirement to code, you’re not alone.

But thanks to clever innovations like Delta’s API Copilot and a clean, no-barriers crypto trading platform, trading smarter with automation is now something every trader can try. In India alone, the algorithmic trading market is expected to record an annual growth of 11.6% with valuation growing from $1+ billion in 2024 to over $2.6 billion by 2032.

This post will take a look at how algo trading on Delta Exchange can help you trade smarter, stress less, and possibly boost results – all in plain language beyond the technical hype.

Algo Trading Isn’t Just for Coders Anymore

Sure, once upon a time, algorithmic trading was an exclusive club. To join, you had to master coding languages, deal with APIs, and operate your own servers. The whole process felt out of reach and reserved for quant geeks or big institutional players. The result? Most retail traders stuck to manual trades, missing out on the speed and consistency that algorithms bring.

The good news is, that model is old news.

Delta Exchange offers tools that reduce the learning curve, so anyone – even those who’ve never written a single line of code – can set up, test, and launch automation strategies. Whether you want to automate small-scale BTC trades or run basket order strategies on crypto derivatives, the doors are open.

Meet API Copilot: Your No-Code, AI-Powered Trading Partner

Delta Exchange makes algo trading smoother with API Copilot

Delta Exchange has made automation accessible and seamless using the API Copilot. This is like an AI assistant – ready to help build, tweak, and avoid common crypto trading mistakes.

Here’s how it helps you trade smarter:

- No coding required: Say what you want, and API Copilot crafts the code without you needing any prior programming knowledge.

- Visual builder: For people who prefer drag-and-drop, the platform lets traders visually design entry and exit rules using a simple interface – combine market indicators, set position sizing, layer on stop-losses, and generate automated plays.

- Risk-free testing: Before putting any real money on the line, traders can switch to demo mode, check how the bot would have performed historically, and see payoff charts detailing profit and loss scenarios.

The takeaway? There’s more value in planning and testing your strategy than learning to code. API Copilot puts the spotlight on smart strategy construction, not technical complexities.

Why Algorithmic Trading Works So Well for Crypto

Crypto is a 24/7, super-fast market. Price swings happen at all hours, and manual trading means always being on alert – or missing out. Algo trading flips that worry on its head:

- Around-the-clock action: Algorithms don’t sleep, nap, or get distracted. Set them up and they’ll execute your trades even if you’re offline.

- No impulsive emotion: Algorithms don’t get greedy or scared, so you’re more likely to stick to your plan and avoid impulse mistakes.

- Fast execution: In volatile derivatives markets, a split-second can mean the difference between a win and a loss. Algorithms fire off trades instantaneously, giving you a natural edge over manual traders.

In India, this style of trading is catching on fast. Reports show that almost 60% of trades in the country now take place via algorithms.

Wide Product Choice and Seamless Platform

Delta Exchange isn’t just a coder’s playground. It’s designed for flexibility and easy exploration:

- Diverse derivative products: Choose from crypto futures, options, and trackers, with support for BTC, ETH, and many altcoins.

- Adjustable leverage: Scale up risk with up to 200x leverage or dial it down for safer, smaller bets – the choice is yours.

- Execution and liquidity: Strong trading volumes ensure that when your algorithms fire, orders get filled quickly and at fair prices.

And the best part – everything, from setup to order execution and withdrawals, can be managed right in INR, saving you from the headache of currency conversions.

Handle Risk Like a Pro

Smart algo trading isn’t about going “all-in” on black-box bots. What sets Delta apart is its focus on risk management:

- Strategy builder: Test everything before going live. Use built-in payoff charts to visualise possible returns and potential losses, so there are no nasty surprises.

- Incorporate stop-loss, position-sizing, and other safeguards: Embed these risk tools in every strategy – API Copilot helps you automate safety nets, keeping losses in check.

- Backtesting: Preview performance over historical data and only deploy strategies that meet your criteria.

Even if you’re new, this structure builds confidence and nurtures better habits.

Getting Started

Learn algo trading on a reliable crypto trading platform

Trading smarter with automation is just a few steps away:

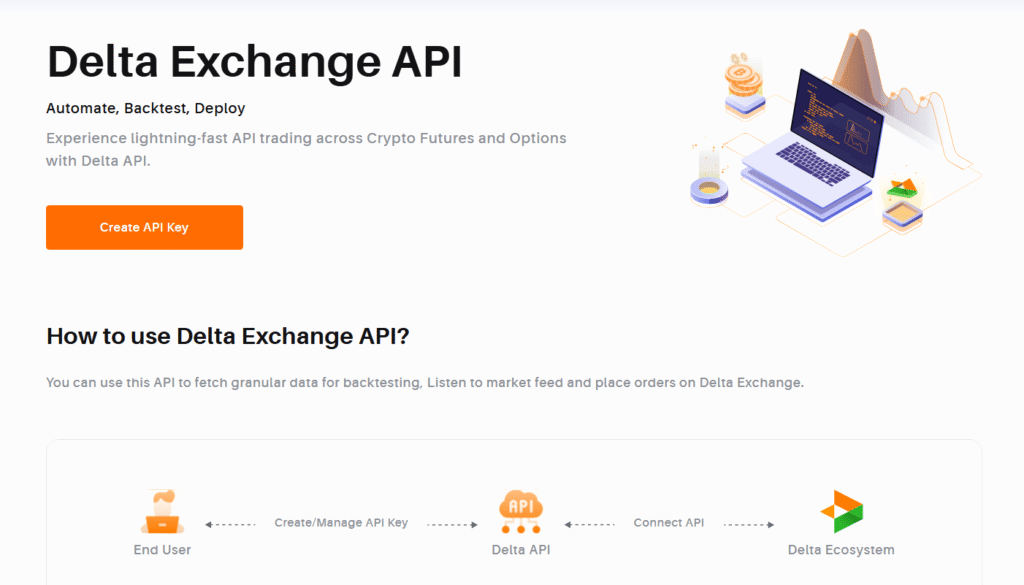

- Register on Delta Exchange and create an account.

- Generate an API key in your dashboard.

- Access AlgoHub and launch API Copilot.

- Describe your strategy or start with presets – the Copilot handles the code.

- Test in demo mode, review results, and tweak the details.

- Go live, monitor, and optimise – all without ever needing to write your own scripts.

You can upvote or downvote Copilot’s suggestions, which helps it get better over time.

The Pros and Cons: Staying Smart About Automation

Why traders love it:

- Results are timely, consistent, and rules-based.

- It’s easy to diversify and run algo trading bots, each sticking to its chosen strategy.

- You can start simple and scale; Delta’s system grows as you do.

What to be aware of:

- Automation is only as good as the rules you set – markets can still surprise.

- Tech glitches or outages (though rare) can impact performance, so regular monitoring is wise.

- Sudden market shocks can throw off even well-designed bots.

Delta’s emphasis on demo testing and its educational resources help users avoid getting blindsided.

Wrapping Up

Delta Exchange reduces the complexity of algo trading by bringing visual builders, AI-guided strategy design, and no-code automation to every user. Instead of worrying about code, you can concentrate on what really matters – refining, testing, and optimising winning trades.

To start testing algo trading, visit www.delta.exchange and join the community on X for the latest updates.

Disclaimer: Investing in cryptocurrency entails bearing the high risk of market volatility. Kindly research before investing.

I’m a professional writer with over 10 years of experience in the field of cryptocurrency. I have written for some of the biggest names in the industry, including Bitcoin Magazine, CoinDesk, and The Blockchain Observer. My work has been featured in major publications such as The Wall Street Journal, Forbes, and Time. I am also a regular contributor to CNBC, where I provide analysis and commentary on the latest trends in the cryptocurrency market.